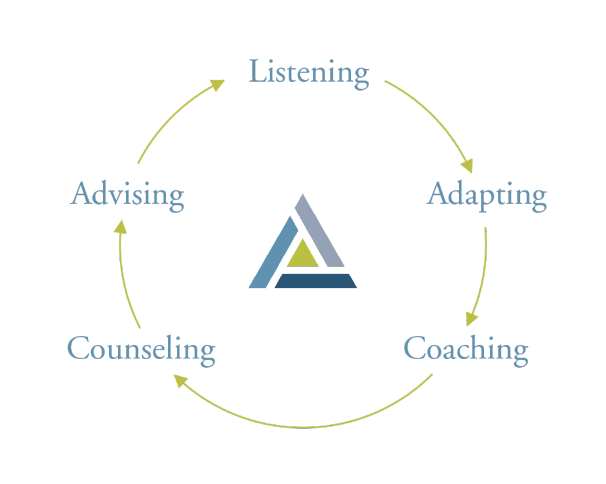

Our Process

Understanding

Vision Discovery

We help you clarify your goals so you can understand how your money can help support the life you want.

We begin by asking the right questions to determine how you relate to money – how you think and feel about it – and what is most important to you.

What do you

value most

in life?

What

motivates

you?

What are you

passionate

about?

What do you want to

achieve, experience

and share?

What drives

your decisions

surrounding money?

Planning

Purposeful Strategy

Knowing what you value, we design a strategy that aligns your vision with your financial reality. The strategy looks at the present and to the future, remaining flexible and setting guardrails to help you stay on course since life does not always follow a plan.

Implementing

Aligned Portfolio

We build a portfolio customized to your needs. We construct the portfolio to efficiently maximize your opportunities for success, managing costs, taxes and risk.

Monitoring

Ongoing Support

We engage with you, your plan and your portfolio and leverage technology so you always know where you stand, and update your investments as your situation evolves.

We are with you every step of the way.

Life and

Goal Planning

We meet with you to understand your life aspirations – the why behind financial freedom – so that you can work toward specific goals like leaving a legacy or buying a second home.

Cash Flow and

Tax Planning

We analyze your cash flow and any debt, review insurance and social security, and initiate tax management and income distribution planning.

Education

Planning

We guide you on costs of private, college, graduate and post-graduate education, available savings accounts and the best way to fund education costs.

Group Benefits

Planning

We help you make the best decisions about retirement plans, group benefits and group insurance options.

Corporate

Benefits Planning

We provide insight into stock options, deferred compensation and concentrated stock analysis.

Business Succession

Strategies

We develop financial and risk management strategies to help protect wealth upon the retirement, disability or death of a business owner or a key employee.

Exit

Planning

We help entrepreneurs and business owners address the personal, tax, legal and financial factors related to the sale of a business.

Risk

Management

We help protect you from risk, reviewing your insurance needs including life and disability, long-term care, property and casualty, and health.

Estate and

Charitable Giving

We guide you on wills and trusts, multigenerational planning, entity planning and philanthropy.

Wealth

Aggregation

We provide a secure online portal so that you can review your aggregated investment accounts in one place.

Family Governance

Planning

We meet with you and your family to discuss multigenerational issues, including strategies for investments, education, income distribution and trustee designation.

Retirement

Planning

We provide planning and investment strategies to help you achieve your lifestyle and income goals in your post-career years.

Insurance Planning

We coordinate your insurance needs, aligning your liquidity needs with your objectives through portfolio construction, insurance acquisition, reviews and reporting.